After the Time Skip: COVES, GAIA, and Capitalizing on the Country Factor

The “After the Time Skip” series is our back-to-form updates on a variety of subjects that we were discussing prior to the long period of silence on the blog. So far we’ve discussed the disappointing now of DeFi/blockchain technologies failing to put the consumers interests over the owners’, and will be continuing to dive into other topics. This post revolves around an update on the Country-Oriented Volatility-Enhanced Strategy, or COVES, concept that pair toggled a country’s equity index with a volatility hedge triggered by sentiment-based momentum.

It’s no secret that a lot of what we’ve been focusing on at Novatero has been in the lens of grouping equities by country. Just take a look at this site and my SSRN author page: outside of a strange obsession with getting the Kings to implement the Grinnell System and a couple of financial forensics papers, the main focus has been on strategies that either group global equities by country (CEILING/GAIA, COVES) or look within a country to capture and report on/invest off of short-term profit-seeking at the expense of long-term company health (EASE and something yet-to-be-published, stay tuned!).

This was done with purpose: no matter the industry, no matter the executives running it, no matter the general health of the company’s financials, big changes in how a country is run will change the water level for all companies in a country’s market. Yes, the magnitude of this will be different on a company-by-company basis (which is where additional factors come in), but the overall health of an economy will ebb and flow based on the movements of the whole. A cursory search on the disconnect between the top 7 stocks of the S&P 500 (aka the “Magnificent 7”) turns up a lot of hits on how much of the growth of the past couple of years have been these stocks dragging up the rest of a lagging market, or vice-versa. A stock or group of stocks can escape the gravity of the overall mass for a little while, but it will inevitably come back into the fold at some point. In fact, it’s the internal motion that typically results in the volatility of a market.

As mentioned in the past, one of the biggest thorns in the side of a long-term, buy-and-hold strategy are the periodic downturns in the market that erase gains and postpone the attainment of thresholds in an investor’s portfolio. The bugbear is how to mitigate or even capitalize on this. Fortunately, the correlation between a market and its volatility tends to be a very strong anti-correlation, with clusters of high-volatility days occurring in close proximity to one another during market downturns. This was one of the events that we hoped to harness with our Country-Oriented Volatility-Enhanced Strategy, or COVES. Put 70% of the investment in the market, but take the remaining 30% and toggle between a market long position and a volatility long position based on a robust volatility-based momentum signal. The theoretical implementation of COVES is outstanding and ubiquitous across the 45 countries we tested in our initial work. Large improvements in returns, with the stability of the long market position greatly reducing the volatility of the switch in the combined COVES-XX implementation.

So, what’s the issue?

Well, volatility is a fickle beast. The CBOE Volatility Index (VIX) isn’t an index like the S&P 500. It does not have underlying assets and is therefore not able to be directly invested in. Sure, there are VIX-derived ETFs, but these are based on VIX derivatives like future and options and thus have a built-in decay that will eat into any gains over time that an investor can manage to eke out. The hope was that Decentralized Finance would offer up a pathway to creating an investable, synthetic VIX, but as we touched on last time, the promise of DeFi has become subject to the whims of project creators and has lost the plot as a mechanism for the masses.

At my core I am a stubborn man, so despite a straightforward avenue for a volatility position, I decided to press onward and start investing in COVES. I started this back in October 2023 by running two COVES-US variants in-parallel. The first variant would initially start by holding a position in the SVIX ETF when the switch favored a long market position, while the second would short the UVXY ETF when the switch favored a long market position. The reasoning for this is that both of these lean into the volatility decay factor: shorting a bundle of VIX futures via the SVIX ETF or shorting a short-term VIX position via the UVXY ETF should allow for the built-in decay to positively affect the held position even if the underlying VIX index wasn’t moving all that much. These switches were initially paired 70:30 SPY:switch variant and were rebalanced to this ratio every three months. Figure 1 shows the performance of these two switches, the overall COVES variants, and the SPY benchmark.

Figure 1. Statistics for the two switch investment types, the COVES variants based on them, and SPY after six months. The period covered runs from October 2023-April 2024.

Despite a really good return for SPY over the six months between October 2023 and April 2024, both COVES variants were able outperform the benchmark thanks to really good returns from the ETF and Short switches.

Confident in how well this test was going, I opted to expand the variants at this point. The ETF switch would now toggle between the original SVIX position and a position in SPXS when a volatility long position was showing. The other variant would switch away from a shorting strategy and would instead opt for VIX Puts/Calls when the switch called for a market hold or a volatility hold.

Why move away from the shorting strategy? Well, holding a short in a volatility product is a very risky proposition, and while it can pay off well when it works, losses can outpace the initial investment when volatility spikes. Switching over to options meant that the position could only lose a maximum of what was initially invested.

As Figure 2 shows, this was very much done at the right time.

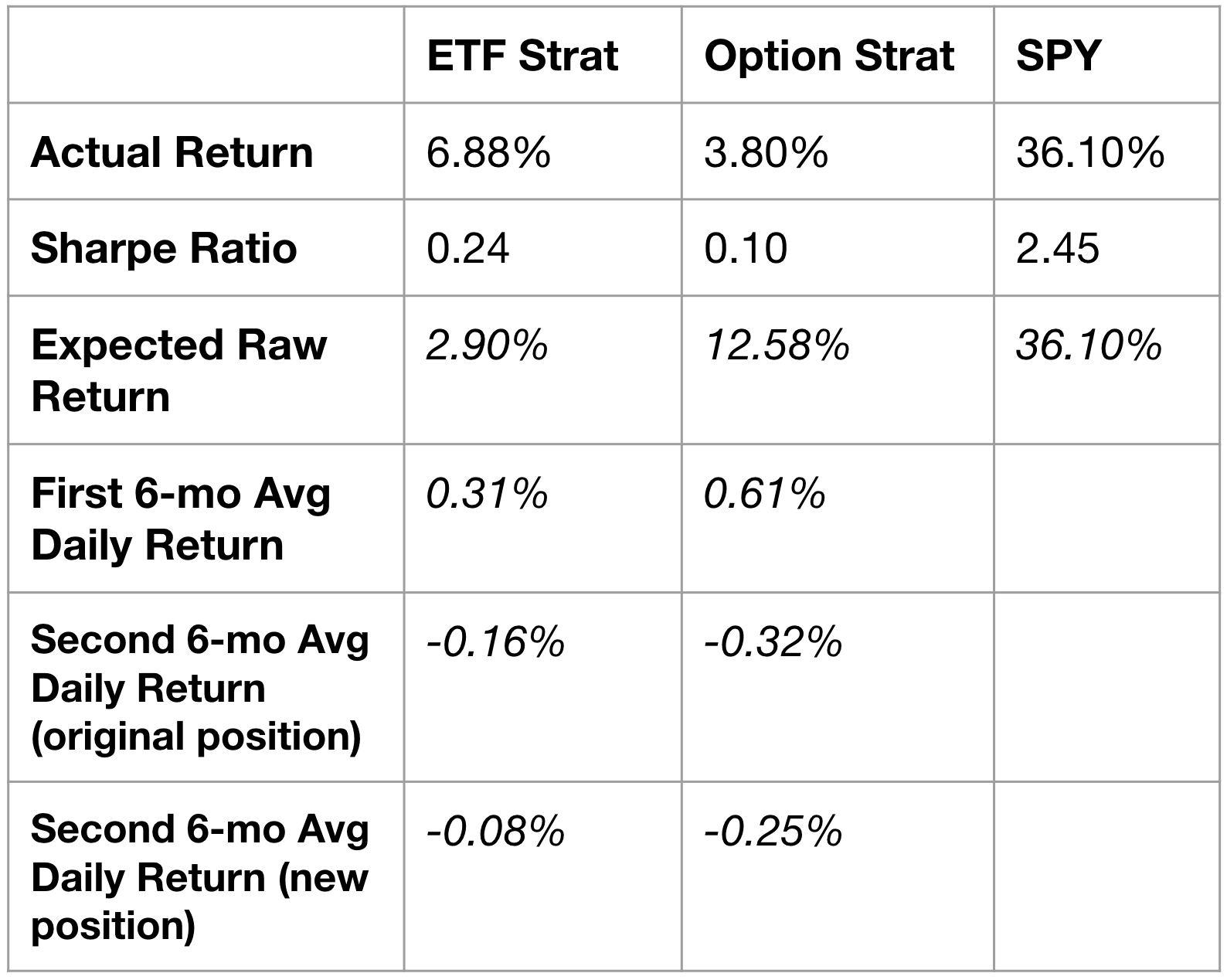

Figure 2. Statistics for the two switch investment types, the COVES variants based on them, SPY, and the traded GAIA variant (GAIA-LO) after one year. 6 month returns are based on May 2024-October 2024.

Good lord, what happened here?

Basically, there was a bad five-month stretch for the momentum factor that makes up the switch. It missed two large volatility movements during that span, namely the moves in May and August. On the plus side, the rebalance to 70:30 SPY:COVES kept the variants from falling too far, with both ending a year of trading at around 27%. Also, not being short a volatility product during this time kept the Short/Option variant from getting entirely wiped out, so that’s good!

I dove a little deeper into what exactly happened in Figure 3 below. Outside of SPY continuing to rip upward, the ETF and Option switch variants performed relatively close to theoretical expectation. Introducing the other side of the switch actually improved the return in the second six months, with the original side of the switch being the laggard in performance between April and October.

However, one thing became evident after months seven through twelve: VIX Options were lagging behind expected returns. Again, the decay factor associated with a derivative based on an index with no underlying assets is a killer, and it turned out to be too much of an anchor to keep going. The Option variant was paused after a year and will remain so while I paper trade an adaptation using SPY Calls/Puts.

Figure 3. Additional performance details for the ETF and Option switches and SPY from after 12 months of activity.

You might have also noticed an additional strategy sneaking into the table in Figure 2. Since the volatility hedging aspect of COVES went sour for almost half a year, I wanted to see how SPY’s rip stacked up against another strategy also looking to displace a standard SPY position. GAIA’s inclusion here is more of a personal curiosity rather than a deflection away from COVES: I have been holding a modest position in GAIA for years now and don’t really consider it as much as I should, especially since I run the code and update positions for it every single weekend. The fact that GAIA seems to rip even harder than SPY in bull run environments is a huge point in favor of GAIA as a strategy, and while it will like cede ground to COVES when the market environment inevitably shifts, it does show its bonafides as a buy-and-hold ex-US supplement to SPY, if not a full replacement for it or other ex-US ETFs like VEU.

Figure 4. Three-month return checkpoints for the two switches, their COVES variants, SPY, and the GAIA variant.

To end this on a positive note, Figure 4 shows total returns at 3-month intervals for the switches, the COVES variants, SPY, and GAIA from October 2024 through to January 2025. The ETF switch has bounced back well in the last three months, pushing the COVES ETF variant into a three-horse race with SPY and GAIA after 15 months. If those five months are indicative of an occasional aberration in the switch rather than an indictment of a persistent flaw, then COVES still holds a lot of merit as a hedged strategy for holding a long position in a market that won’t get eaten alive by high-volatility events.

Between the good-bad-good(?) enactment of tradable variants of COVES and the robust buy-and-hold performance of GAIA, it does seem as though sorting the global equity market through a country lens holds utility in a variety of executions. GAIA and COVES are two that we will continue to pursue, but there’s a lot more currently in the works at the moment. The expansion of GAIA from a country-by-country strategy to an equity-by-equity strategy continues apace, so expect the Global Anomalous Equity Allocation (GAEA) follow up…probably before summer.

But beyond overarching, global investment products like GAIA and GAEA, I keep returning to the root concept behind COVES-XX: providing investors with a stable buy-and-hold product that both allows them to have a stake in their domestic market while also mitigating drawdowns.

COVES-US is easy, thanks to a market index like the S&P 500 and a volatility index like VIX.

Those other 44 countries in the COVES paper and blog post weren’t too tricky on the theoretical end: use an ETF representing their stock market and create a synthetic volatility index to power the switch.

But what happens when the country has an underdeveloped stock market? What if there is no stock market?

COVES-HT in the COVES post was an initial attempt at this: Haiti's lack of a stock market and overall turbulence makes it a candidate for needing a way to collectively get itself out of the poverty trap.

(We’ll go ahead and ignore all the historical kneecapping that France and the United States did to punish Haiti for having the gall to succeed at overthrowing their enslavers in this exercise, but strongly encourage readers to educate themselves on this heinous page in history.)

In absence of a stable, robust, or any stock market, we can attempt to synthesize one based on international, publicly-traded companies operating within Haiti. Think of it this way: if Disney opens up a new resort just outside of Cap-Haitien, it stands to reason that the success of that resort should have an effect on the Haitian economy. A synthetic COVES-HT would have DIS in the index, and the COVES hedge would protect against Disney pulling out, or having a poorer-than-expected tourist season. Yes, it does mean that the Haiti index would be more influenced by foreign business effects than a typical, internal stock market, but that’s already an inevitability for smaller countries in the global economy.

Now, take this idea and propagate it to any country and its peoples that could benefit from pegging its economic health to the success of large, foreign companies profiting off of its resources.

A COVES-CD that allows the DRC and its people to share in the success of its cobalt mines (and use that return to argue for better conditions, etc.).

A COVES-ET that allows Ethiopians to both make up for the lack of a stock market and a fairly large commodity market.

A COVES-TM that could provide Turkmens the leverage to finally oust the Berdimuhamedows.

It’s a great idea, and the construction makes sense, but how do you get around the initial cost to create an ETF for what will likely be a low-AUM offering? Well, about that…